After Western nations announced bans on Russian oil last year in response to the invasion of Ukraine, a Greek refinery that serves the U.S. military moved quickly to adapt. Within months, it told investors it had stopped accepting the forbidden oil and had found other sources instead.

Forbidden Russian oil flows into Pentagon supply chain

After multiple changes of ownership, the fuel is sold to a Greek refinery that serves the U.S. military, a Post examination finds

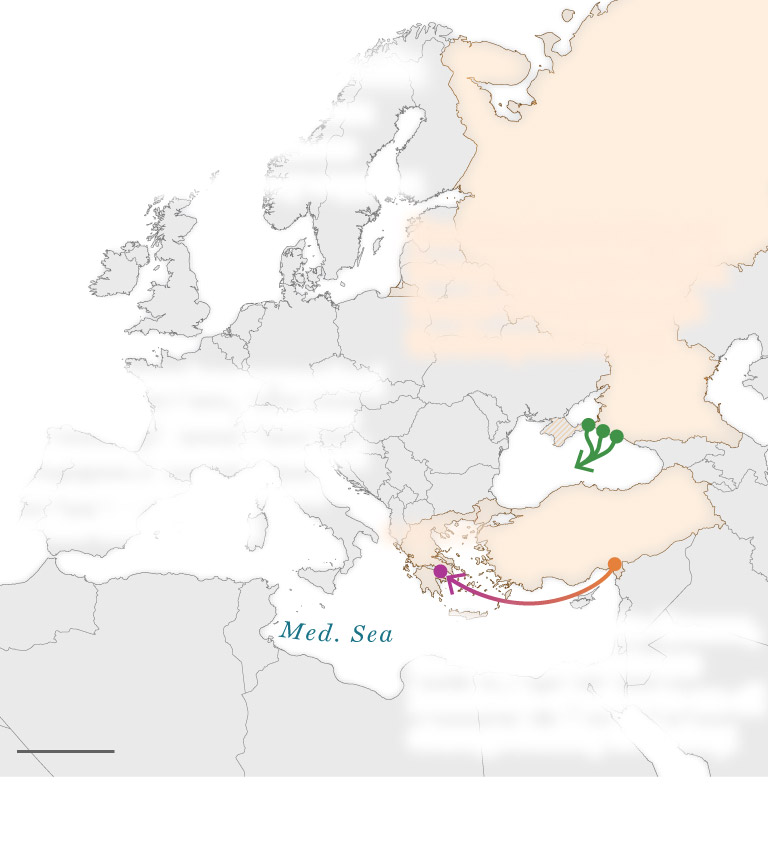

Petroleum products that originated in Russia kept flowing to the Motor Oil Hellas refinery on the Aegean Sea in Greece, a Washington Post examination of shipping and trade data found. They just took a new route, hundreds of miles out of the way through an oil storage facility in Turkey, a journey that obscured Russia’s imprint as ownership of the products changed hands multiple times before they reached Greece.

Russian fuel in the Pentagon

supply chain

Banned Russian petroleum products take a

circuitous route to a U.S. military supplier.

RUSSIA

Russian fuel is shipped

from ports on the Black

Sea to Turkey through

the Bosporus strait.

The fuel is no longer

marked as Russian

when it arrives in

Greece, where it’s mixed

into a supply purchased

by the U.S. military.

Kavkaz and

Taman

Novorossiysk

Tuapse

Black

Sea

Dortyol

shipping

terminal

TURKEY

GREECE

Motor Oil

Hellas refinery

Before heading to Greece,

the shipment detours

hundreds of miles to an oil

storage facility in Turkey.

400 MILES

Note: Crimea was illegally annexed by Russia in 2014.

NICK MOURTOUPALAS / THE WASHINGTON POST

Russian fuel in the

Pentagon supply chain

Banned Russian petroleum

products take a circuitous

route to a U.S. military supplier.

RUSSIA

Russian fuel is shipped

from ports on the Black

Sea to Turkey through

the Bosporus strait.

The fuel is no longer marked

as Russian when it arrives

in Greece, where it’s mixed

into a supply purchased

by the U.S. military.

Kavkaz and

Taman

Novorossiysk

Tuapse

Black

Sea

TURKEY

GREECE

Dortyol shipping

terminal

Motor Oil

Hellas refinery

Before heading to Greece,

the shipment detours

hundreds of miles to an oil

storage facility in Turkey.

400 MILES

Note: Crimea was illegally annexed by Russia in 2014.

NICK MOURTOUPALAS / THE WASHINGTON POST

Russian fuel in the

Pentagon supply chain

RUSSIA

Banned Russian petroleum products

take a circuitous route to a U.S.

military supplier.

RUS.

Russian fuel is shipped

from ports on the Black

Sea to Turkey through

the Bosporus strait.

Novorossiysk

Kavkaz and

Taman

Tuapse

Black

Sea

The fuel is no longer marked

as Russian when it arrives

in Greece. There the fuel is

refined and mixed into a

supply purchased in part

by the U.S. military.

TURKEY

GREECE

Dortyol shipping

terminal

Motor Oil

Hellas refinery

Before heading to Greece,

the shipment detours

hundreds of miles to an oil

storage facility in Turkey.

400 MILES

Note: Crimea was illegally annexed by Russia in 2014.

NICK MOURTOUPALAS / THE WASHINGTON POST

On the surface, the refinery’s sourcing of fuel oil from the Dortyol shipping terminal in Turkey seemed to affirm pronouncements by the White House and European leaders that embargoes on Russian oil were working as planned, depriving President Vladimir Putin of crucial revenue to fund his military aggression in Ukraine. The fact that those shipments contained material that originated in Russia underscores the porousness of the sanctions and the failure to aggressively enforce them.

The quantities of fuel oil shipped from Dortyol to Motor Oil Hellas, and the industry practice of mixing products of different origins as they are stored, ensure a large amount of product from Russia in the mix, according to industry experts with deep knowledge of oil flows and sanctions rules who reviewed the shipping and trade data at the request of The Post.

“I don’t see any other possible conclusion than Russian fuel is going to Motor Oil Hellas,” said Robert Auers, a refinery modeler and refined fuels market analyst at the research firm RBN Energy, who examined the Post findings.

The Post used shipping and other records to track the flow of fuel oil, a category of materials used to make products the Pentagon buys for ships and planes. The Project on Government Oversight, a nonprofit watchdog group based in Washington, surfaced some of those shipping records while preparing a report with information from Data Desk, a consulting firm that investigates fossil fuel companies.

Over the past two years, Dortyol received 5.4 million barrels of fuel oil by sea, all but 1.9 million from Russia, according to shipping records and trade data from Refinitiv, a financial-data firm that specializes in commodities markets. Since the European Union sanctions took effect in February, Russian shipments to Dortyol totaled 2.7 million barrels, or more than 69 percent of the fuel oil shipped by sea to Dortyol during that period.

Also since February, The Post found, Dortyol has shipped 7 million barrels of fuel oil overall, of which 4.2 million barrels went to Motor Oil Hellas. Those shipments accounted for at least 56 percent of all the fuel oil the Greek refinery received by ship.

The precise amount of Russian-origin fuel oil in the products the Pentagon purchases could not be determined. Those products are refined using multiple ingredients that cannot all be tracked through production.

It also could not be determined whether, at some point during its journey, the fuel oil from Russia was relabeled as having come from another country. The documents that describe the provenance of an oil shipment, known as certificates of origin, are not public records.

The Pentagon has inked nearly $1 billion worth of new contracts with the Greek refinery since the U.S. ban took effect in March of last year, federal contracting data show.

Since February, more than 1 million barrels of jet fuel from Motor Oil Hellas have also gone to government and corporate buyers in Italy, France, Spain and Britain, according to shipping records.

Joe Yoswa, a spokesman for the Pentagon’s Defense Logistics Agency, which handles fuel purchases for the U.S. military, said in an email that the agency has “no knowledge” of fuel from Russia being routed to its Greek supplier. The agency said its contractors, including Motor Oil Hellas, “are responsible for ensuring compliance with applicable laws and regulations concerning business with Russia and Russian companies” and “must certify their compliance with such laws and regulations as part of the acquisition process.”

There is only so much the Pentagon can do to police suppliers, Yoswa wrote. The products going into the fuels it purchases from Motor Oil Hellas are “subject to change on a constant basis and could be different from one delivery to the next,” he wrote. Tracing its origins “for a specific delivery of refined product would be difficult or impossible,” he wrote.

Motor Oil Hellas said in a statement that the company “does not buy, process or trade Russian oil or products. All its imports are certified of non sanctioned origin.” The company did not respond to specific questions about the nature of that certification, or whether it is taking any steps to ensure it is accurate.

Turkish state officials and representatives of the Turkish Petroleum Corporation, which took ownership of several of the fuel oil shipments to Dortyol, did not respond to questions regarding the fuel’s origin.

Officials at Global Terminal Services, which owns the Dortyol facility, said in an email they are merely an “intermediary” to store products and at no point own the products they store. They said they do not accept shipments from Russian-flagged vessels and “fully comply with applicable local and international rules and regulation,” including maintaining a “robust compliance process” regarding sanctions regimes.

Under sanctions rules, Turkish facilities are permitted to accept Russian fuel. The Greek refinery cannot.

‘A very light regulatory approach’

In at least five shipments this year from Russia to Dortyol, the fuel oil was initially owned by the Russian oil giant Rosneft, trade records show. After it was loaded onto a tanker on the Black Sea, the cargo was purchased in each case by a firm based in the United Arab Emirates. Ownership of the fuel oil was later transferred to entities controlled by the Turkish state oil company, and the product was delivered to Dortyol.

In an email to The Post, a Rosneft spokesperson said the company does not track the destination of the fuel it sells but is in “strict compliance with generally accepted international standards.” The UAE firm, Fossil Trading FZC, did not respond to requests for comment.

Under the guidelines for the E.U. embargo, purchasers “should exercise appropriate due diligence in assessing the origin of the oil and should rely on documentation at their disposal to determine the origin of the oil, which may include certificates of origin.”

U.S. and E.U. regulators have repeatedly warned companies that certificates of origin may be fraudulent. Numerous authorities and companies have the power to draw them up, and there is no centralized system to confirm their authenticity.

In the oil industry, Turkey has become known as a place where such certificates are unlikely to be challenged, said George Voloshin, a financial crime expert with the Association of Certified Anti-Money Laundering Specialists.

“They are not actively trying to stop this,” Voloshin said. “They have no incentive. It is a very profitable trade that brings money to Turkey, which is on good terms with Russia. … So they take a very light regulatory approach, preferring to trust the documents given to them without questioning.”

Western sanctions were designed to strike a severe economic blow against Russia, where oil and gas revenue make up nearly half of the federal budget and help fund the war effort.

But the Russian economy has proved unexpectedly resilient, in no small part because of widespread sanctions evasion. Western leaders have taken a cautious approach to cracking down on violators, even as Russia’s oil revenue surged over the summer, climbing to levels not seen since before the ban was fully implemented. The cost of its oil has broken through a price cap imposed by the West, leaving the Biden administration grasping for strategies to stop sanctions evasion.

The Treasury Department, which administers and enforces economic sanctions, declined to respond to specific questions about the origin of products the U.S. government buys from Motor Oil Hellas, but issued a statement through spokeswoman Megan Apper. “We are focused on coordinating with our allies and partners to decrease Russia’s revenue from its oil sales and to limit the Kremlin’s ability to fund its barbaric war against Ukraine, including through our price cap on the maritime export of Russian energy exports,” she said.

Beyond penalties imposed on two shippers earlier this month, enforcement has been scant.

“This is clearly something you would think the administration would not want to have happen,” said Brian O’Toole, an Atlantic Council fellow and former senior adviser to the Office of Foreign Assets Control (OFAC), which oversees U.S. sanctions. “I would like to be able to say at least the part about the Department of Defense buying this fuel surprises me, but it doesn’t … Treasury has only just started to wade into enforcement of these sanctions.”

O’Toole and other sanctions experts said buying fuel that had simply been rebranded is off-limits for European refiners and their customers. And purchasers may be deemed liable even if they were not aware of the origin of a potentially sanctioned good, they said.

“OFAC has a long history of sanctioning people that should have known,” O’Toole said.

Motor Oil Hellas, a publicly traded firm, has been a key Pentagon supplier for years. Since the 2019 fiscal year, the Defense Logistics Agency has paid the company more than $1.1 billion, making it one of the top 10 contractors with the agency among providers of fuel and oil products, according to the firm Deltek, which tracks U.S.-government procurement data. A $479 million purchase order was finalized in May.

The Project on Government Oversight (POGO), which advocates for government transparency and whistleblower protections, shared its initial findings with The Post after tracking several months of commodities data. As this story was published, the group posted its own findings in a report titled “The Pentagon is Buying Fuel Made With Russian Oil,” written by investigator Jason Paladino.

Most of the additional records The Post used for this reporting were sourced from Refinitiv and Kpler, a platform that tracks global energy commodities. Together, the records show when products left a particular terminal, who owned the goods, which vessels they were shipped on and where they were unloaded. The Post also reviewed satellite imagery and ship-tracking data from MarineTraffic to confirm port visits by vessels.

The journey of vacuum gas oil

One type of fuel oil that appears to take this circuitous journey from Russia to Greece is vacuum gas oil, which an analysis of the Motor Oil Hellas refinery by the research firm Wood Mackenzie shows is an ingredient in the types of jet fuel the refinery sells to the U.S. military.

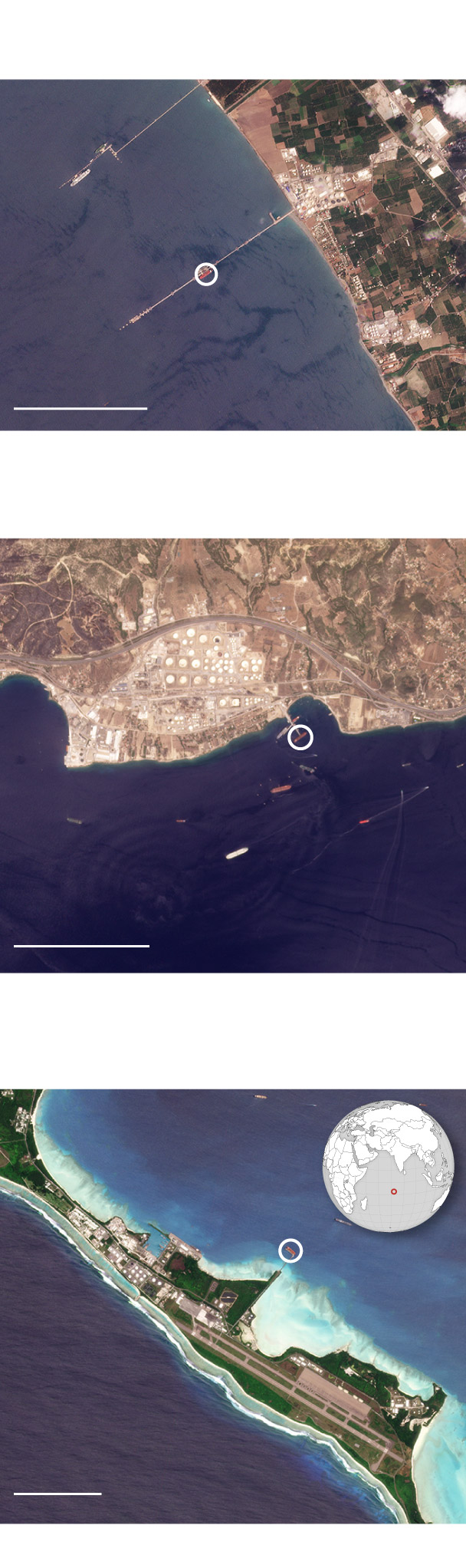

On July 5, the Elbrus is seen at the Dortyol facility

after loading 198,000 barrels of vacuum gas oil

from the Novorossiysk port in Russia.

TURKEY

Dortyol shipping

terminal

Mediterranean

Sea

Elbrus

1 MILE

On July 20, satellite imagery shows the vessel

Stone I at the Motor Oil Hellas Refinery after

departing with a load of vacuum gas oil from

Dortyol.

GREECE

Motor Oil

Hellas Refinery

Stone I

Aegean

Sea

1 MILE

On Oct. 2, the Overseas Sun Coast is seen in

satellite imagery at Navy Support Facility Diego

Garcia, a small U.S. Navy base, after loading $38

million worth of jet fuel refined at Motor Oil Hellas.

DETAIL

Overseas

Sun Coast

Navy Support

Facility Diego Garcia

Indian

Ocean

1 MILE

Source: Planet Labs

NICK MOURTOUPALAS / THE WASHINGTON POST

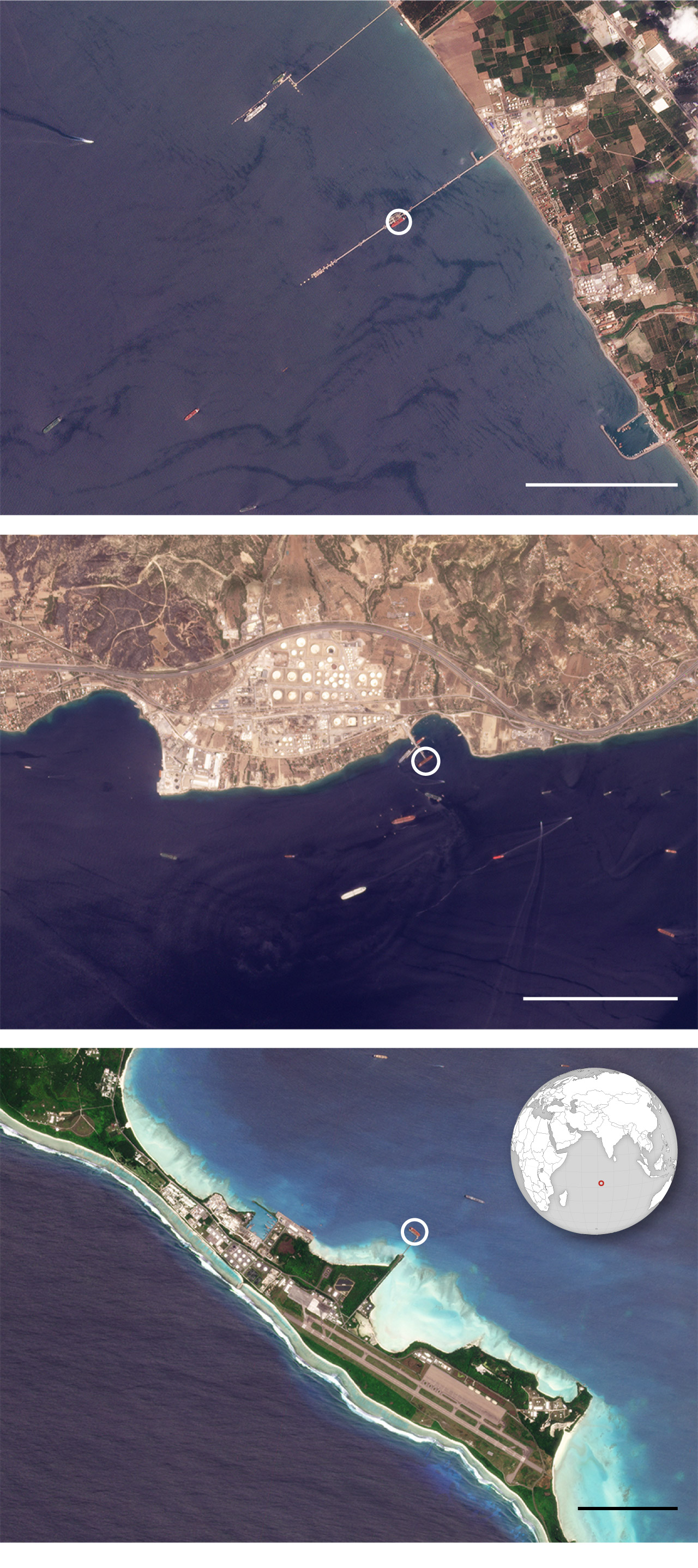

TURKEY

Dortyol

shipping terminal

On July 5, the Elbrus is seen

at the Dortyol facility after

loading 198,000 barrels of

vacuum gas oil from the

Novorossiysk port in Russia.

Elbrus

Mediterranean

Sea

1 MILE

GREECE

Motor Oil

Hellas Refinery

Stone I

On July 20, satellite imagery

shows the vessel Stone I at the

Motor Oil Hellas Refinery after

departing with a load of vacuum

gas oil from Dortyol.

Aegean

Sea

1 MILE

DETAIL

Overseas

Sun Coast

Navy Support

Facility Diego Garcia

Indian

Ocean

On Oct. 2, the Overseas Sun

Coast is seen in satellite

imagery at Navy Support Facility

Diego Garcia, a small U.S. Navy

base, after loading $38 million

worth of jet fuel refined at

Motor Oil Hellas.

1 MILE

Source: Planet Labs

NICK MOURTOUPALAS / THE WASHINGTON POST

Since February, all the vacuum gas oil that has gone to Dortyol, or at least 1.7 million barrels, has come from Russia, according to shipping data.

Shipping and trade records show 198,000 barrels of Russian vacuum gas oil arrived in Dortyol in July, having changed owners several times along the way. A shipment of a similar size moved from Dortyol to Motor Oil Hellas several weeks later. The same shipping pattern has played out many times since the U.S. and E.U. bans took effect, The Post found.

“There’s a stream of VGO going to Turkey and miraculously, the same VGO happens to end up in Greece,” said Viktor Katona, head of crude analysis at Kpler.

Once at Motor Oil Hellas, that vacuum gas oil is mixed in with much larger amounts of crude oil from other countries in a unit specially designed to make jet fuel with those ingredients.

Other Russian-origin fuel oil products that have been shipped to Dortyol in large quantities can be used to make naval diesel. Vessels from the Turkish terminal have then delivered such products to Motor Oil Hellas, which sells naval diesel to the U.S. military.

Under the sanctions, Motor Oil Hellas and other Western purchasers cannot import Russian petroleum products. They can import products made with Russian oil if that oil was extensively refined and turned into a different fuel after leaving Russia. In such circumstances, the new product can be labeled as having come from the country where the refining occurred, experts said.

Analysts said Dortyol does no such refining, and the owners of the terminal said in their statement that they “do not have any direct relationship with either refinery or producer.” Because of the infrastructure needed, the products could not be extensively refined while transiting the Black Sea.

“The sanctions are quite explicit on that,” said Alan Gelder, a vice president of refining, chemicals and oil markets research at Wood Mackenzie. “You need to put it through a refinery and a transformation process. That is not happening here.”

The U.S. military is picking up products from Motor Oil Hellas on tankers with names such as Overseas Sun Coast, Stena Polaris and Valtellina. The tankers are then depositing the fuel in such places as the Rota naval base in Spain, home to several U.S. warships, a U.S. Air Force base called Lajes Field located in the Azores Islands and NATO’s Souda base on the Greek island of Crete.

In early September, $38 million worth of jet fuel refined at Motor Oil Hellas using vacuum gas oil was loaded onto a U.S.-flagged tanker and delivered weeks later to Navy Support Facility Diego Garcia, a U.S. Navy base in the Indian Ocean.

Jet fuel and naval diesel from Motor Oil Hellas is flowing through Europe and beyond at a time Western leaders are growing increasingly anxious about the effectiveness of the sanctions, and Ukrainian officials are warning the lax approach to enforcement is directly undermining its effort to expel Russian forces.

“No country in the world will be safe if we impose sanctions and do not enforce them,” Oleksandr Novikov, head of Ukraine’s National Agency on Corruption Prevention, said in a statement provided to The Post. “If Russia, despite the restrictions, is able to supply oil above the price cap and sell it to the countries that have imposed sanctions, will the threat of such sanctions deter other aggressors from starting a war? The answer is obvious: no.”

Turkey is hardly unique in helping facilitate robust sales of Russian fuel products. Refineries in India have been thirsty for Russian oil since the United States and the E.U. moved to impose the price cap. The cap enabled India to get a lucrative deal on Russian crude, which industry data show now accounts for 40 percent of the oil flowing into that country, where it is refined and can often then be exported elsewhere.

In theory, the sanctions were designed to allow the continued flow of such oil, so long as Russia is forced to sell it at a very deep discount. But lax enforcement is also leading to violations of the price cap, with widespread cheating allowing Russia to sell its oil for significantly more money than the sanctions allow.

The Biden administration’s threats of a crackdown are belied by the contracts of its own military, which experts say is complicit in sanctions evasion if it is using petroleum products that originated in Russia.

“The U.S. military has not done its due diligence on the origin of this oil,” said Isaac Levi, an analyst at the Centre for Research on Energy and Clean Air, a European nonprofit that tracks the flow of Russian oil. “It is not hard to see where it is coming from.”

Graphics by Nick Mourtoupalas. Dan Lamothe contributed to this report.